RFP

Affordable For-Sale Development

The Urban Redevelopment Authority of Pittsburgh (URA) requests proposals from non-profit developers or for-profit developers with non-profit applicants for projects involving the substantial rehabilitation or new construction of affordable for-sale housing for the For-Sale Development Program (FSDP).

RFP Details

Resources & Addendums

- Register for Non-Mandatory Pre-Proposal Meeting

- PDF Version of URA FSDP RFP

- Exhibit A - FSDP Program Guidelines

- Exhibit B - FSDP Application Narrative

- Exhibit C - URA MWBE Narrative Requirements

- Exhibit D - FSDP Excel Workbook

- Exhibit E - FSDP Evaluation Criteria

- FSDP RFP on Ion Wave Technologies - For Q&A and Proposal Submission

Introduction

Background Information

The purpose of FSDP is to provide construction financing to nonprofit or for-profit developers (with non-profit applicants) for the substantial rehabilitation or new construction of for-sale housing. The FSDP provides low interest rate construction financing and/or grants for the purpose of increasing the supply of affordable housing for homeownership and to eliminate substandard housing by ensuring compliance with applicable codes and standards.

Goal of RFP

The goal of this RFP is to solicit proposals from development teams comprised solely of non-profit applicants OR for-profit applicants in partnership with a non-profit as part of the development team. FSDP intends to provide financing to projects that will result in affordable homeownership opportunities.

Definitions

For the purposes of this RFP, the following terms shall mean:

- “URA” refers to Urban Redevelopment Authority of Pittsburgh

- “HOF” refers to Housing Opportunity Fund·“FSDP” refers to For-Sale Development Program

- “The Program” refers to FSDP

- “DCED” refers to the Pennsylvania Department of Community and Economic Development

- “Borrowers” refers to development teams

Program Objectives

Full FSDP Program Guidelines are attached to this RFP (EXHIBIT A)

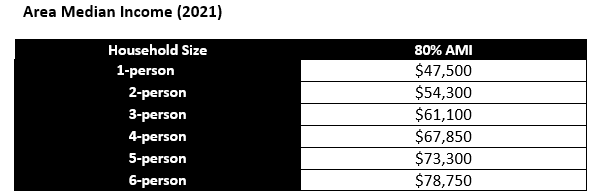

FSDP provides loans or grants to borrowers for the creation and/or preservation of affordable units. The Program is designed to increase the supply of decent affordable housing for homeownership; eliminate health, safety, and property maintenance deficiencies; and ensure compliance with applicable codes and standards. Upon completion of the project, the unit must be sold to owner-occupants at or below 80% AMI.

Eligibility Requirements

Eligible Borrowers

1. Non-profit developers;

2. For-profit developers;

To be eligible for HOF funding, a for-profit developer must enter into a Memorandum of Understanding and/or Letter of Intent with the nonprofit entity which describes the relationship between the nonprofit applicant and the for-profit developer.

Borrower Requirements

1. Be in good standing and qualified to borrow within the Commonwealth of Pennsylvania.

2. Have the legal capacity and all necessary legal and corporate authorization to incur the obligation of the loan.

3. Agree in writing to assist with the relocation of tenants displaced as a result of the rehabilitation or new construction.

4. Agree in writing to pay Davis-Bacon Prevailing Wages and State Residential Prevailing Wage to extent required by the Federal Government and the Commonwealth of Pennsylvania.

In accordance with City Council Bill No: 2016-0602, “Non-Profit” means a non-profit organization (1) that is exempt from taxation under Section 501(c)(3) of the Internal Revenue Code and (2) that is providing affordable housing or combating community deterioration among its tax-exempt purposes. The term shall not include a non-profit organization which is controlled by a for-profit or public entity. The term “Neighborhood-Based Non-Profit” means (1) a non-profit that has a substantial base of operations within the neighborhood where the housing to be funded by the HOF is located, or (2) a tenant association that represents the tenants in the housing to be funded by the HOF.

If a for profit developer is working in cooperation with a non-profit developer, to be considered a complete proposal, applications must include an executed agreement between the non-profit applicant and for-profit developer. This document should detail the role of each party during different development phases (design/pre-construction, construction, post-construction, etc.), joint responsibilities, as well as other details that comprehensively describe the development team’s composition and function.

Eligible Properties

To be eligible for the FSDP, the following requirements must be met:

1. Each property constructed under FSDP must be a permanent structure within the City of Pittsburgh primarily for year-round, owner-occupied residential use.

2. Each property must comply with local zoning requirements.

3. An eligible borrower must own the property prior to or at the FSDP closing. The borrower shall provide assurance of title or evidence of ownership that is acceptable to the URA and consistent with prudent lending practices.

4. Upon project completion, properties financed under FSDP must be sold to owner-occupants who are at or below 80% of the Area Median Income (AMI).

5. For properties being rehabilitated under FSDP, rehabilitation costs must equal at least 20% of the total development cost of the project.

6. Eligible housing types include detached, semi-detached and townhouse units. Multiple unit structures developed as condominiums or cooperatives are also eligible.

7. Each property must comply with Environmental Review regulations and procedures to the extent they are required by the Federal Government and/or the Commonwealth of Pennsylvania.

Eligible Activities

Funds under the Programs may be used for the acquisition of property, site preparation and development, as well as the hard and soft costs associated with the rehabilitation and new construction of single family for-sale housing. CDBG funds will only support rehabilitation of single family for-sale housing.

Eligible Costs

Loans and grants may cover property acquisition costs; site development costs; hard costs associated with the construction of the project; and soft costs associated with the project, such as appraisal fees, architectural and engineering fees, legal fees, construction interest, insurance during construction, financing fees and closing costs. FSDP grants used to fund construction activities will trigger prevailing wages.

FUNDING TERMS, LIMITS AND REQUIREMENTS

All loans and/or grants for property development shall be made in conformance with the requirements set forth below:

Affordability Period

1. For developments where the FSDP funds mut be used as a loan, the affordability period will be for a minimum of 15 years. A deed restriction will be recorded on the property.

2. For developments where the FSDP funds are used for a grant only, or for both a loan and a grant, the affordability period must be for will be for a minimum of 15 years but not more than 99 years. A deed restriction will be recorded on the property.

Forms of Financing

FSDP financing can be lent/granted in one or more of the following forms:

1. Construction loan to be repaid by the sale of the housing units.

2. Construction grant to bridge the difference, or a portion of the difference, between total development cost and the forecasted sales price(s) of the housing unit(s).

3. Predevelopment loan to a non-profit developer prior to the developer taking title to the property to be developed or prior to construction loan closing The predevelopment loan may be used for costs necessary to determine the feasibility of the proposed development including, but not limited to:

i. Site control (option or sales agreement)

ii. Design development

i. Geo-technical analysis

ii. Environmental analysis

iii. Engineering

iv. Reasonable costs of obtaining additional sources of pre- development financing

Maximum Funding Amount

1. The maximum amount of FSDP funds per rehabbed unit cannot exceed $70,000.00. FSDP funds may be conveyed in more than one form (e.g., loan, grant, deferred mortgage commitment); however, the total FSDP investment shall not exceed $70,000.00 per rehabbed unit.

2. The maximum amount of FSDP funds per newly constructed unit cannot exceed $100,000.00. FSDP funds may be conveyed in more than one form (e.g., loan, grant, deferred mortgage commitment); however, the total FSDP investment shall not exceed $100,000.00 per newly constructed unit.

3. If FSDP funds are conveyed in the form of a construction loan, the maximum loan amount will be limited to 30% of the post-appraised value of the project for for-profit developers.

4. If FSDP funds are conveyed in the form of a grant, the maximum grant amount cannot exceed the difference between the total development costs and the total proposed sales price(s) for the project unit(s).

5. If FSDP funds are conveyed in the form of a predevelopment loan, the maximum amount of the FSDP pre-development financing cannot exceed the lesser of (i) 50% of the URA-approved predevelopment budget, (ii) $33,000.00 per housing unit, or (iii) $100,000.00 where the project occurs on multiple properties.

Interest Rate

1. All FSDP construction loans made to for-profit developers will bear an interest rate between 2% and 4%.

2. All FSDP predevelopment loans and/or construction loans made to nonprofit developers will bear an interest rate of 0%.

Maximum Loan Term

The maximum term of a FSDP loan is eighteen (18) months. With prior URA approval, a FSDP loan note may be extended for an additional six to twelve (6 - 12) months term.

Loan and Grant Disbursement

1. All proceeds from the FSDP loan and grant will be escrowed at the URA. Additionally, the URA may also ask that the borrower’s cash equity contribution be escrowed at the URA. Proceeds from a non-FSDP conventional loan may be escrowed with the participating lending institution provided that said institution enters into a disbursement agreement with the URA.

2. The disbursement of loan proceeds will occur as follows:

a. Borrower’s cash equity shall be released initially.

b. All other funds will be released in accordance with the Disbursement Agreement prepared or approved by the URA.

3. All proceeds shall be disbursed in accordance with a URA approved draw schedule. The draw schedule shall be based upon completion of specified work items, or a percentage of construction completed. Loan and/or grant funds may not be disbursed if there is a default on any term or condition of the loan and/or grant documents.

PAYMENT PROCEDURES

Payment Eligibility

Payments shall be made based on work completed. Payments may be made for materials delivered and securely stored on the site with prior approval from the URA.

Final Payment

For loans and grants, final payment shall be made as follows:

1. The borrower shall submit to the URA a Certificate of Completion executed by the borrower and contractor certifying that all work has been completed in accordance with the contract documents.

2. Upon final inspection, receipt and approval of the Certificate of Completion, final payment will be processed.

3. If, in the opinion of the URA, the contractor has satisfied the contract terms and the borrower refuses to request or release the final payment, the URA may require the borrower to explain in writing within ten (10) days why the URA should not make direct payment to the contractor. The URA shall refer the case to the governing body responsible for arbitrating construction disputes.

Closeout Procedures

After final payment is made, the URA shall reconcile all receipts and disbursements. Any funds remaining in the loan account shall be applied to the principal balance of the loan.

LOAN APPROVAL PROCESS

After a complete response to this RFP is submitted, URA staff will review each response and submit summary documents from all submittals to the appropriate parties for funding recommendation or non-recommendation.

All FSDP loans and grants to be sourced by Housing Opportunity Fund (HOF) proceeds are subject to the review of the HOF Advisory Board. FSDP awards in excess of $250,000.00 must be presented to and approved by the URA Board of Directors. FSDP awards equal to or less than $250,000.00 must be approved by the URA’s Director of Residential & Consumer Lending and Executive Director.

LOAN AND GRANT CLOSING

Loan and grant closing will be scheduled at a time acceptable to the borrower and the URA. All taxes and assessments against the property which are due and payable shall be paid before closing.

The URA may charge the borrower for the following items which may be financed by the loan:

1. Recording fees and recording taxes or other charges incidental to recordation

2. Required survey charges and appraisal fee, if applicable

3. Title examination and title insurance, if required

4. A construction services fee

5. An URA construction services fee in an amount of $500 per unit in a maximum amount of $15,000.00;

6. An URA origination fee equal to 2% of the total FSDP loan and/or grant proceeds.

7. An URA legal fee in the amount of $500 per unit

8. Other reasonable and customary charges or fees authorized by the URA

CONSTRUCTION STANDARDS

All properties constructed or rehabilitated under The Programs must comply with all relevant codes of Allegheny County and the City. All contractors involved with The Programs shall meet all licensing requirements necessary to perform the construction.

MINORITY AND WOMEN-OWNED BUSINESS ENTERPRISE PARTICIPATION (MWBE)

The URA has a long history of diversity and inclusion within all its programs and other activities. The URA encourages the full participation of minority and women business owners and professionals in this effort. The URA requires that all respondents demonstrate a good faith effort to obtain minority and women-owned business participation in work performed in connection with URA projects. The URA acknowledges and adheres to the City’s goal of 18 percent (18%) minority and 7 percent (7%) women participation.

A MWBE narrative needs to be included with the respondent’s proposal. See “Exhibit C” for MWBE Narrative Requirements. MWBE participation can be satisfied by:

i. Ownership/Partnership of firm;

ii. Use of minority or women-owned businesses as vendors;

iii. Subcontracting with firms owned and controlled by minorities and/or women. If this is to be done, that fact, and the name of the proposed subcontracting firms, must be clearly identified in the proposal.

For selected proposals, where total project costs are expected to meet or exceed $250,000, a MWBE plan will need to be submitted as part of the ongoing MWBE review and approval process. Any questions about MWBE requirements should be directed to Performance and Compliance at mwbe@ura.org.

Specific to this RFP, the URA will require that all FSDP borrowers demonstrate a good faith effort to obtain MWBE participation in work performed in connection with this program, including, but not limited to, construction requirements in FSDP program guidelines (Exhibit A).

PROPOSAL DEADLINES AND REQUIREMENTS

Important Bid Notification Announcement

Please note that the URA is now using Ion Wave Technology (IWT) as its bid notification and RFP Question and Answer (Q&A) platform. In addition to following the Submission Requirements, respondents must also register at: https://ura.ionwave.net/Login.aspx to submit questions for response.

See Addendum A – Instructions for Registering on IWT.

RFP Anticipated Timeframe

| RFP Issue Date | August 25, 2021 |

| Non-Mandatory Pre-Proposal Meeting | September 14, 2021 |

| Written Questions Period | All questions will be received and aswered on the IWT Platform |

| Questions & Answer Response Release | Ongoing |

Pre-Proposal Meeting

A non-mandatory Pre-Proposal Meeting will be held on September 14, 2021 at 2:00pm.

This meeting serves as an opportunity to have questions answered about the RFP, submission process, and the FSDP guidelines. All questions and answers from the Pre-Proposal Meeting will be posted on IWT.

Register through Zoom: https://zoom.us/meeting/register/tJckdeuprzIuGN08i0kukS-IYb1TR4TZln6T

Questions and Answers

All inquiries should be submitted through IWT. All questions and answers will be made public on IWT.

Submission Requirements

All application submissions are to include a completed FSDP Application Narrative and include all applicable attachments listed in the Attachments Checklist (Exhibit B).

The Application Narrative is comprised of the following sections:

1. Eligibility Checklist

2. Development Team Information

3. Project Information

4. Project Narratives

5. Excel Workbook

All sections of the Application Narrative must be completed to the best of the applicant’s ability to be considered a complete application.

All submissions and questions must be electronically submitted through IWT.

SELECTION CRITERIA AND APPLICATION REVIEW

Fully completed applications will be evaluated in accordance with the Program. FSDP Evaluation Criteria are attached to this RFP (Exhibit E).

Application review may take up to 60 days during which URA staff may contact applicants to discuss materials submitted. Selected applications will be advanced for loan approval consideration.

Applications will be evaluated using the criteria below:

1. Feasibility Criteria

a. Readiness to Proceed

b. Capacity of the Development Team

c. Compliance with Program Funding Guidelines

2. Policy Objectives

a. Geographic Diversity

b. Non-Profit Participation

c. Level of Affordability

d. Affirmatively Further Fair Housing

NON-DISCRIMINATION CERTIFICATION

The URA abides by all applicable laws and regulations regarding nondiscrimination and refrains from discriminating on the basis of age, race, color, religious creed, ancestry, national origin, sex, sexual orientation, gender identity, gender expression, political or union affiliation and/or disability. No person shall be excluded from participation in, be denied the benefits of, or otherwise be subjected to discrimination solely on the basis of any of the above factors under the loan and grant programs operated by the URA.

LEGAL INFORMATION

The URA reserves the right to verify the accuracy of all information submitted. The URA shall be the sole judge as to which respondent(s) meet the selection criteria. The URA reserves the right, in its sole discretion, to reject any or all responses received, to waive any submission requirements contained within this RFP and to waive any irregularities in any submitted response.

By responding to this RFP, proposers acknowledge that the URA has no liability to any individual or entity related to this RFP or any proposal and/or the URA’s use or nonuse of any such proposal.

ADDENDUM A - Instructions for Registering on IWT

The Urban Redevelopment Authority of Pittsburgh (URA) is proud to announce the transition from the use of Public Purchase to Ion Wave Technology (IWT), a cloud-based bidding platform.

Effective January 6, 2021, all interested parties can submit Requests for Proposals, Requests for Qualifications, and bidding opportunities through the following link, which is located on the URA Proposals & Bids page: https://ura.ionwave.net/Login.aspx.

To be notified of all opportunities, please complete the registration process via the detailed instructions below.

INSTRUCTIONS

The registration process with the IWT cloud-based eProcurement service requires completion of the following steps:

1. Visit this link to begin the registration process: https://ura.ionwave.net/Login.aspx

2. Begin registration by clicking on the Supplier Registration box to the right of the Login box.

3. Complete all required fields marked with a red asterisk (*) within each section to advance to the next step. Please click Return to return to any previous section and edit any information. Complete all required info in this section and click Save.

4. Verify your email address to proceed with Supplier Registration after completing the Company Information section.

5. Complete the remaining Supplier Registration sections:

a. Changes to auto-populated fields will require you to edit the identified previous section used to populate the field.

b. IWT will send notifications for future bid opportunities related to any of the IWT Commodity Codes selected from the “Commodity Codes” section.

6. Review the registration information and click “Register Now” to successfully conclude the registration.

7. Access the URA Supplier portal using your login information to view bid events and opportunities available to your organization. All registered parties are responsible for keeping information up to date, particularly contact information and email addresses.

NEED ASSISTANCE?

If you need any assistance with this process, or encounter an issue setting up the registration, please contact Ivy Alexander at ialexander@ura.org.