OwnPGH Homeownership Program

Financing for homebuyers in the City of Pittsburgh

The OwnPGH Homeownership Program (OwnPGH) provides up to $90,000 to homebuyers seeking to purchase a home within the City of Pittsburgh.

About the Program

Homebuyers may receive up to $90,000 total, in the form of a grant, for the purchase of a house within the City of Pittsburgh.* The grant may be available for those with a household income of 80% of Area Median Income (AMI) or below.

*Currently, we are only accepting OwnPGH applications for new construction or rehabilitated homes that have been funded by the URA.

Who Can OwnPGH Help?

- Individuals and families who qualify for a home loan through one of our four banking partners, listed below.

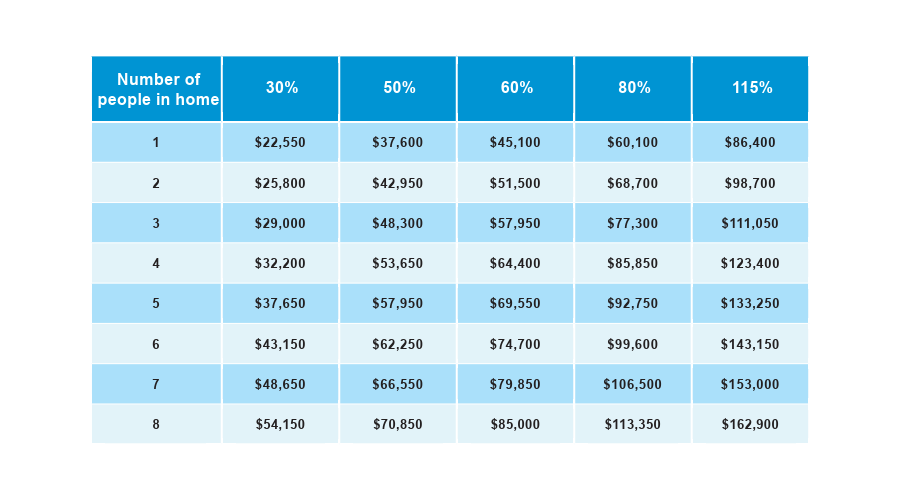

- Individuals and families who earn less than 80% of the area median income. Use the chart below to see if your total household income is less than the income limit.

- Individuals and families who are purchasing property in the City of Pittsburgh. Currently, we are only accepting OwnPGH applications for new construction or rehabilitated homes that have been funded by the URA.

OwnPGH Income Limits

2025 Area Median Income

Homebuyers must have a combined household income below 80% of the annual median income.

OwnPGH Bank Partners

Please contact one of the four banks below to find out if you pre-qualify for a home loan. Once you confirm pre-qualification for a home loan, the bank will help you with your application to the OwnPGH Program.

First Commonwealth Bank

Joseph Tomaceski

412-495-2337

jtomaceski@fcbanking.com

SSB Bank

Heather Dieckmann

412-837-6955

hdieckmann@ssbpgh.com

Dollar Bank

Steven Kaminski

412-261-4219

SKaminski205@dollarbank.com

S&T Bank

David McGowan

412-915-7997

DavidMcGowan@s&tbank.com

Post-Closing Stewardship Services

The URA is partnering with City of Bridges Community Land Trust to provide stewardship services to all OwnPGH homebuyers. Services include, but are not limited to:

- Service as the first point of contact in case of mortgage trouble or delinquency

- Advocacy for and support of all OwnPGH homeowners during times of payment difficulty, under-employment, or unemployment to ensure that they remain stable

- Provision of staff support and legal representation for any required tax assessment appeal hearings

- Referrals to additional resources as may be required (Examples: housing assistance, employment resources, job training, etc.)

- Monitoring and oversight of all OwnPGH deed restrictions, including an annual proof of residency check to ensure that homes are occupied in the manner required by OwnPGH

To contact City of Bridges regarding any post-closing services you may need, please email stewardship@cityofbridgesclt.org.

Our Partners

Sharina (OwnPGH Program Participant) at the closing of her home.

New homeowner, Jamira, with her daughter at the closing of their new home.

Annette (OwnPGH Program participant), and her family after purchasing their home.

New homeowner, Daiona, celebrating the purchase of her new home through the OwnPGH Program.

Sierra (OwnPGH Program Participant) at the closing of her home purchase.

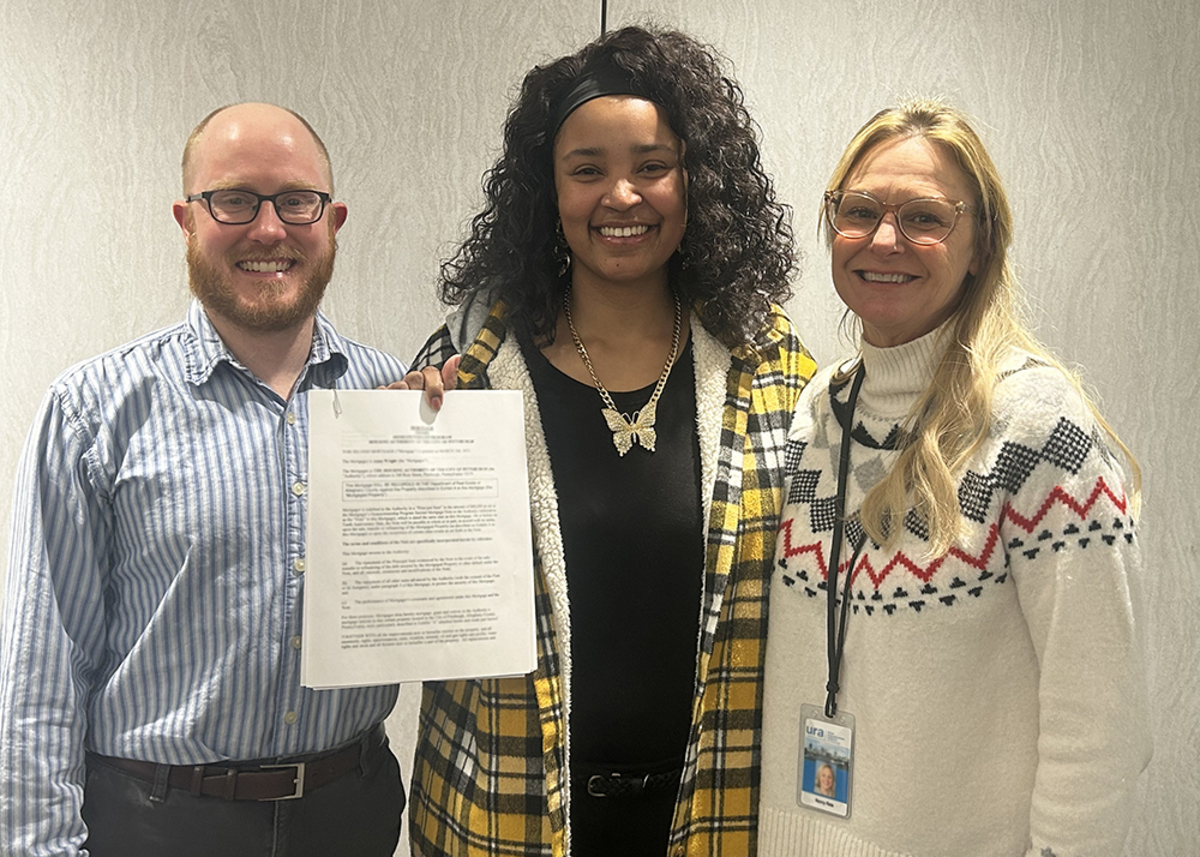

Homebuyer Anna Wright (middle), pictured with URA and PHDC staff, utilized assistance from the OwnPGH Homeownership Program to purchase her first home for her family.

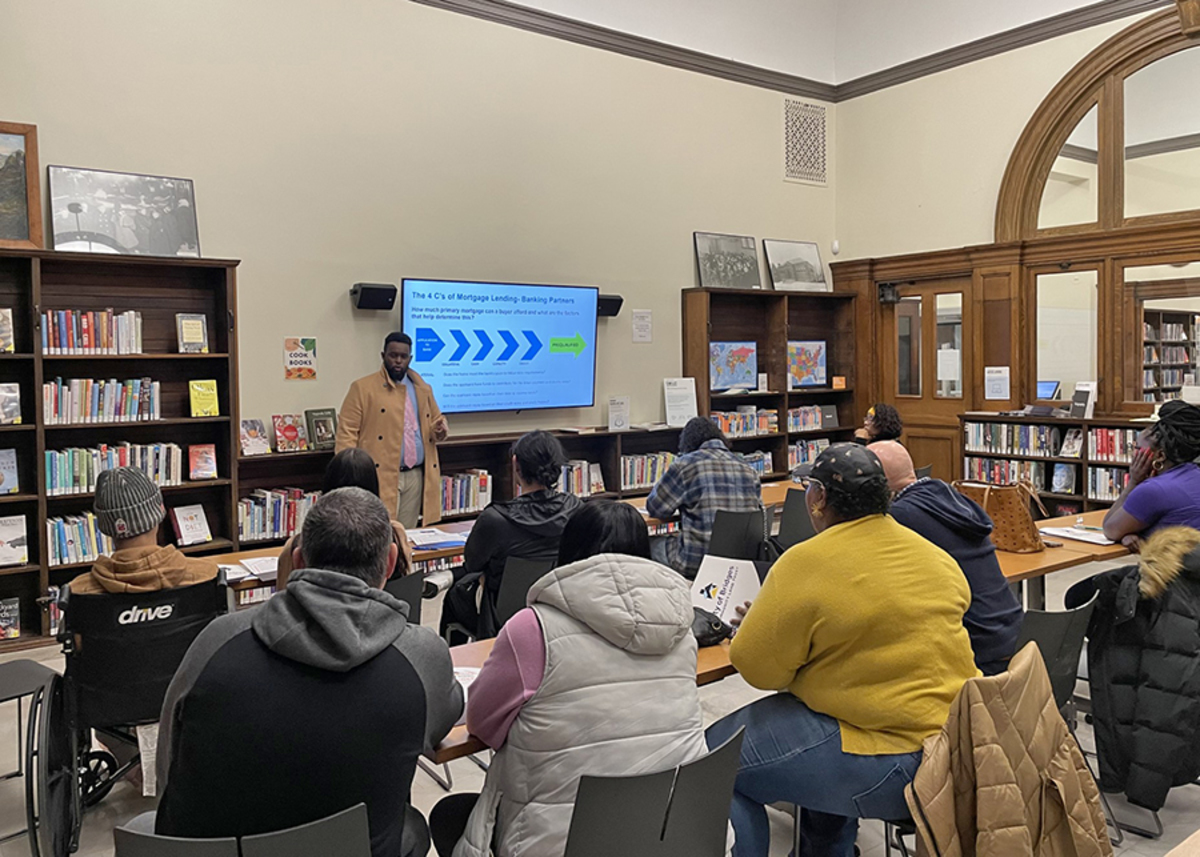

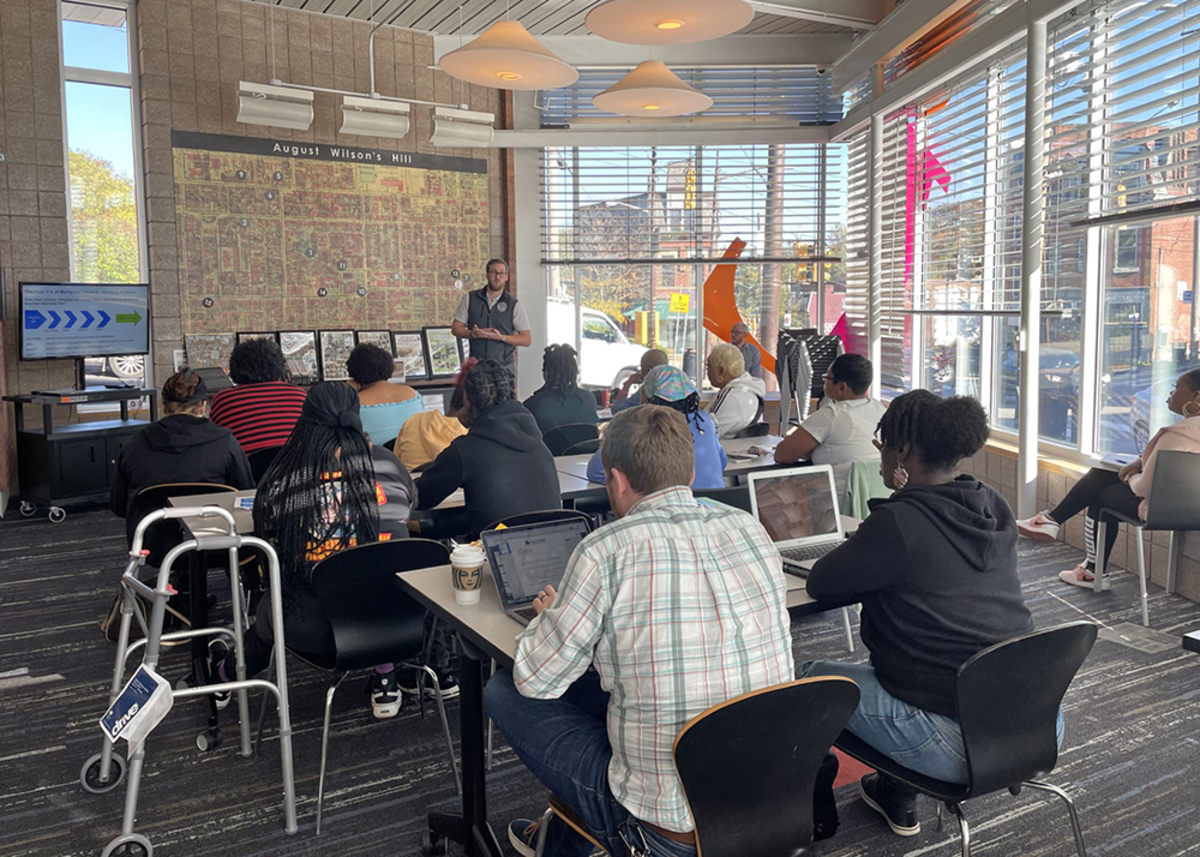

David McGowan of S&T Bank engages with a crowd of potential homebuyers during OwnPGH Office Hours at the Mt. Washington Carnegie Library.

URA, City of Bridges Community Land Trust, S&T Bank, and Mt. Washington CDC staff members are partnered to help first-time homebuyers purchase a home in Pittsburgh.

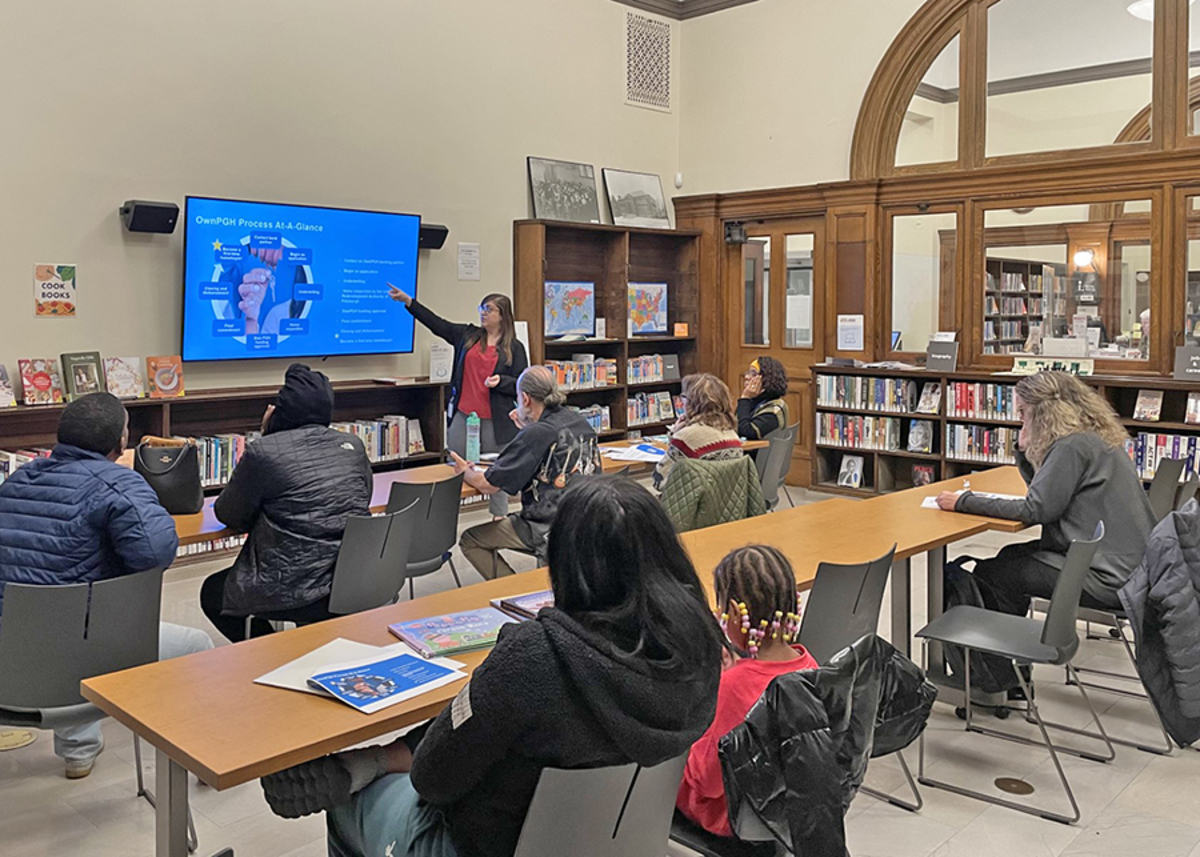

Rae Ann Driscoll, OwnPGH program coordinator, discusses the OwnPGH Homeownership Program process during Office Hours at the Mt. Washington Carnegie Library.

OwnPGH Office Hours on October 24, 2023 at the Hill District Carnegie Library

URA staff with Joseph M. Tomaceski of First Commonwealth Bank and Ed Nusser and Crystal Jennings-Rivera of City of Bridges Community Land Trust at the OwnPGH Office Hours on October 24, 2023 at the Hill District Carnegie Library

Additional Homebuying Assistance

First-time homebuyers making less than 80% of the AMI may be eligible to receive up to $7,500 for down payment and closing costs in the form of a 0% interest, 5-year deferred loan.

Have questions? For more information about the OwnPGH Homeownership Program, please call 412-255-6694 or email OwnPGH@ura.org.