RFP

2018 Homeowner Assistance Program - Program Administrators - Housing Opportunity Fund (HOF)

The Urban Redevelopment Authority of Pittsburgh’s (URA) Housing Opportunity Fund (HOF) Department requests proposals from nonprofits to provide Program Administration services for its 2018 Allocation Year of the Homeowner Assistance Program (HAP).

RFP Details

Contact Information

Resources & Addendums

- Exhibit A - AMI Chart

- Exhibit B - HAP Guidelines

- Exhibit C - HAP Scoring Criteria

- Exhibit D - HAP Application Narrative

- Exhibit E - Attachments Checklist

- Resource - PDF of 2018 Homeowner Assistance Program RFP

- Resource - Presentation from 12/20/2018 Pre-Proposal Meeting

- Resource - Q&A from December 13, 2018 - December 28, 2018 Question Period

HOF Background

The HOF is a housing trust fund that has been established in the City of Pittsburgh (City) to support the development and preservation of affordable and accessible housing within the City’s boundaries. The HOF has allocated funding for five (5) programs to carry out this mission in 2018: Homeowner Assistance Program, Down Payment and Closing Cost Assistance Program for first-time homebuyers, Housing Stabilization Program for at-risk renters, For-Sale Housing Strategy Program, and Rental Gap Program to fund the creation/preservation of affordable housing.

Funds appropriated to the HOF are to be invested in accordance with an annual allocation plan (AAP) created by the Advisory Board and approved by City Council and the Governing Board. The URA Board of Directors serves as the Housing Opportunity Fund’s Governing Board (Governing Board). The Housing Opportunity Fund Advisory Board (Advisory Board) is comprised of 17 persons appointed by the Mayor to four-year staggered terms.

For the 2018 Fiscal Year, $2.375M has been allocated for the HOF HAP. The URA plans to award up to a maximum of $1.875M through this RFP. The remaining $500,000 will be available for the URA to help households with needed water and gas line repairs, or to increase Program Administrator contracts at a later date if needed to service additional houses. Of the $1,875,000 awarded through this RFP, up to $350,000 may be awarded to one (1) or more social service providers to conduct Tangled Title services and or foreclosure prevention services to Borrowers who plan to participate in the HAP.

Of the $2.375M allocated to the HAP in 2018, $1.5M must be used to benefit households at or below 30% AMI (Area Median Income), $625,000 must be used to benefit households at or below 50% AMI, and $0.25M must be used to benefit households at or below 80% AMI.

AMI chart is included with this RFP (EXHIBIT A).

Program Objectives

The main objective of the HOF HAP is to provide financial and technical assistance to eligible Borrowers for rehabilitating and improving residential owner-occupied properties citywide.

Through HOF HAP, the URA provides deferred 0% interest loans and grants to assist low-income Borrowers to: bring their homes into compliance with city codes; undertake energy efficiency improvements; and undertake eligible general property improvements.

Full HOF HAP Program Guidelines are included with this RFP (EXHIBIT B).

a. HAP funds will be deployed in two ways:

- Program Administrators will apply for and be assigned houses by the HOF Department.

- The URA will reimburse administrators for costs incurred on a per house basis.

b. Definitions

For the purposes of this RFP, the following terms shall mean:

- “URA” refers to Urban Redevelopment Authority of Pittsburgh

- “HOF” refers to Housing Opportunity Fund

- “HAP” refers to Homeowner Assistance Program

- “Borrowers” refers to the homeowners

- “Program Administrators” refers to non-profit agencies

RFP Objectives

The purpose of this RFP is to solicit non-profit agencies (Program Administrators) to apply for and administer HOF HAP funds. The URA will enter into contracts with the Program Administrators and reimburse them for costs incurred on a per house basis upon completion of work. Program Administrators will need to apply and be awarded a contract for services. Once Program Administrators are awarded a contract, the URA will assign projects to the Program Administrators. The URA will still record the mortgage on the property.

In locations where a Program Administrator is unavailable, or in areas where the need exceeds the capacity of Program Administrators, the URA will directly service the Borrower.

a. Program Administrator Responsibilities

- Determine homeowner eligibility and provide URA with documentation verifying homeowner income for URA review.

- Coordinate property inspection with URA Construction Advisor and certified Risk Assessor. Prepare a work write-up for URA review with a scope that addresses all health and safety issues, code compliance, and other eligible improvements. Approved work write-ups will be subject to a competitive bidding process or, if renovation will be performed by a Program Administrator, will be subject to the URA review of the Program Administrator’s proposed construction costs.

- Facilitate loan closing between homeowner and URA.

- Oversee all contractors, including Program Administrator’s construction staff, and ensure all licensing, certifications (including lead-safe work practices, if applicable), permitting, and insurance requirements are met, and work is performed on a timely basis consistent with contract and drawings.

- Coordinate construction inspections, including the final inspection with contractor and URA Construction Advisor. Program Administrators may pay contractor for work completed and request reimbursement from URA.

OR

1. Provide Tangled Title and foreclosure prevention services.

b. Program Administrator Compensation

- Program delivery funds may be provided to Program Administrators for reasonable and necessary program delivery expenses including:

i. Appraisal fees

ii. Other program delivery expenses, including an allocation of staff time - Program delivery funds must not exceed 10% of the overall loan/grant for each unit.

- Program delivery funds will be budgeted per property and paid to Program Administrator on completion of a property.

c. Tangled Title and Foreclosure Prevention Services

- Social service providers may apply for funds to assist homeowners with incomes at or below 30% or 50% AMI with Tangled Title issues, estate planning issues and/or

- Funding for these services will be limited up to $350,000.

- Social service providers must specify the number of households they will help at both the 30% and 50% AMI thresholds.

Note: Prior to entering into an agreement with the URA, Program Administrators must be current and in compliance with all tax obligations to the City of Pittsburgh.

Eligibility Requirements

Borrowers receiving loans under HOF HAP must meet the following requirements:

a. Borrower Requirements:

- Be an owner-occupant of property to be improved

- Have an income not exceeding 30%, 50%, and/or 80% of AMI (adjusted for family size):

a. Annual income to be determined by current income projected from date of application, based on gross pre-tax income from all sources

b. Note: For homeowners at 80% AMI, funds are to be used for gas and water line repairs only. The URA will administer these funds directly unless it is determined that a Program Administrator who is already working on the house with the needed gas line or water line repair should include this work as part of the scope of work for the house. - Hold fee simple or life estate interest in the property

- Not have any outstanding real estate taxes or be on a payment plan for at least 6 months

- Have current homeowner insurance policy for the property or apply for a waiver of guidelines

- Own at least half or more interest in the title of the property. All individuals with ownership interest in the property must sign the closing documents.

b. Property Requirements:

- Be located within the City

- Be a permanent structure used primarily for year-round residential use. If property is vacant, the Borrower must certify intent to occupy property within 30 days of work completion.

- Not contain more than two (2) connected dwelling units

- Be the principal residence of the Borrower

c. Required and Eligible Improvements:

- Loans must fund any improvements necessary to remedy the conditions presenting a danger to the health and safety of the property occupants.

a. The URA will conduct an inspection of each property to identify code violations. Improvements to remedy violating conditions must be included in the scope of work to be financed by the loan. If this work exceeds $30,000 and the remainder cannot be financed, the loan may be denied. - Only work that occurs after URA initial inspection and approval of scope of work is eligible for funding.

- For buildings listed in or eligible for the National Register of Historic Places, OR buildings located in a historic district that is listed in or eligible for the National Register, work must conform to the Secretary of the Interior’s Standards for Rehabilitation as reviewed by the City’s Historic Preservation Planner. Any exterior work for designated buildings must be reviewed by the Historic Review Commission of the City of Pittsburgh.

- Funds may be used to finance any general property improvements eligible for financing under the Federal Housing Administration Title I Program. Limits may be established for general improvement items such as flooring, kitchen cabinets, bathroom fixtures, decks, and others.

- Work started prior to URA approval and inspection will not be eligible for loan funds.

d. The priority uses of loan funds will be:

I. Required health, safety and code violation corrections

II. Energy-related improvements

III. Accessibility

IV. General property improvements

V. Tangled Title and Foreclosure Prevention Services

1. Funding for Tangled Title and foreclosure prevention services will be limited to 15% of the total allocation for the program in any given funding year.

e. Inspection and Bidding Procedures:

All properties rehabilitated under HOF HAP are subject to inspections by the URA.

- The URA Construction Advisor will conduct an initial inspection of the property and a certified Risk Assessor will inspect the home to determine the level of lead hazards in the home. Either the URA Construction Advisor or a private Program Administrator will prepare a work write-up which identifies code violations and conditions presenting a danger to the health and safety of the occupants, including lead hazards. The work write-up can also include energy efficiency and general property improvements.

- The URA will review the work write-up to determine a fair and equitable cost of the proposed improvements.

- Approved work write-ups will be subject to a competitive bidding process administered by the URA or subject to the URA review of the private Program Administrator’s proposed construction costs.

- The Borrower may elect to forego the URA bidding process by obtaining his or her own contractor meeting the requirements of Section XI of these guidelines. In the event the Borrower waives the bidding process, the chosen contractor(s) is/are bound by all relevant payment and inspection procedures imposed by the URA.

- The URA Construction Advisor will conduct on-site stage inspections at the time the contractor and/or the Program Administrator requests payment for work completed. The URA will make payments directly to the contractor and/or the Program Administrator based on work completed and an approval by the Construction Advisor and the Borrower. The Program Administrator will make payments directly to the contractor and the URA will reimburse the Program Administrator.

- At the time the work is completed, a final inspection is made by the URA Construction Advisor. A Senior Construction Supervisor or Manager may also inspect the property. If necessary, a City Department of Permits, Licenses, and Inspections Advisor may also perform an inspection of the completed work.

Funding Terms, Limits and Other Restrictions

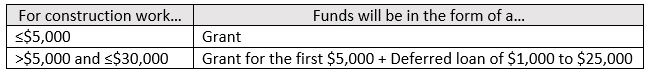

a. Funding Type:

- The loan may be a first or second mortgage loan recorded by the URA.

- Prior to closing the loan, the URA will commission an as-is appraisal to determine current market value.

- The deferred mortgage loan is payable at the earlier of:

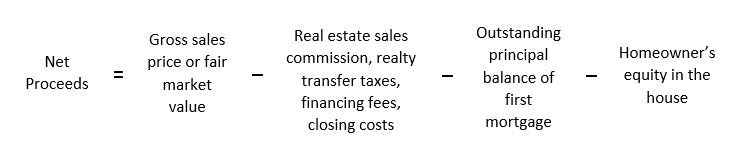

i. 30 years from the date of closingii. Sale or transfer of the property using up to 100% of the Net Proceeds defined as:

- Homeowner’s equity is defined as the original As-Is Appraised Value (commissioned at loan closing) less the outstanding principal balance of the first mortgage at the time of transfer.

- The total amount payable by homeowner shall never exceed the face amount of the note. To the extent that Net Proceeds are less than the outstanding principal balance of this note, the remainder will be forgiven.

- The URA may approve (at its sole discretion) the sale or transfer from homeowner to an income-eligible purchaser at or under 80% AMI who agrees to reside in the property and assume the deferred loan.

b. Limits and Other Requirements

- URA and/or private non-profit Program Administrators will underwrite all loans/grants.

- All closings will be performed by URA and/or Program Administrators.

- At closing, the Borrower is required to pay a construction services fee of $500, which may be financed through the homeowner loan.

- If the Borrower vacates the property, the unpaid balance will be due in full.

- Maximum loan term is 30 years.

- When the loan is due in 30 years, if a low-income homeowner still lives in the house, the loan is forgiven.

- Loans may be assumed with written permission of URA. Proposed assumptions are to be reviewed by a URA committee on a case-by-case basis.

- In the event of a loan default, the URA reserves the right to foreclose.

c. Payments and Procedures

1. Contractors/Program Administrators must request payments on the proper URA form(s), duly signed and approved by the Borrower, for a specified dollar amount. No request for payment will be processed unless the amount of work completed is equal to or greater than the dollar amount applied for according to the URA's contractor payment schedule.

2. Final payments will not be released until all required permits have been approved.

Construction Standards

All properties rehabilitated under the HOF HAP must comply with all relevant codes of Allegheny County and the City of Pittsburgh, the General Specifications of the URA's Housing Rehabilitation Programs, and HUD’s Lead Safe Regulation (24 CFR Part 35).

a. All contractors, including construction staff of Program Administrators, shall:

- Meet all licensing requirements necessary to perform the construction.

- Be of good reputation, financially sound and fully qualified to perform the required work outlined in the work write-up as evidenced by previous professional construction experience.

- Provide insurance coverage for comprehensive public liability, property damage liability, and worker's compensation in form and amounts required by the URA.

- Perform all work covered by the work write-up and drawings in conformance with the contract and all applicable laws, codes and URA construction standards in a competent workmanlike manner equal to the standards of the General Specifications of the URA.

- Comply with all applicable laws, ordinances and regulations relating to the protection and safety of persons and property.

- Furnish all labor, materials and equipment and obtain and pay for all licenses, permits and privileges required to rehabilitate the property in accordance with the contract documents.

- Agree to complete construction according to the specifications of the work write-up within the completion date stated on the agreement.

- Indemnify and hold the URA harmless from all liability and loss due to injury or death of any person or damage to any property which may occur or be alleged to occur during performance of the contract as a direct or indirect result of any act or omission, whether intentional, negligent or otherwise by the contractor, subcontractors or their agent, servants and employees. The contractor shall defend all suits or claims involving the above at his or her sole cost and expense.

- If the Borrower is required to complete lead hazard reduction work, the work must be performed by a certified Lead Abatement Contractor.

Proposal Deadlines and Other Requirements

Important Bid Notification Announcement

Please note that the URA is now using Public Purchase as its bid notification and RFP Question and Answer (Q&A) platform. In addition to following the Submission Requirements, respondents must also register at: https://www.publicpurchase.com/gems/register/vendor/register in order to submit questions for response. See Addendum A – Instructions for Registering on Public Purchase.

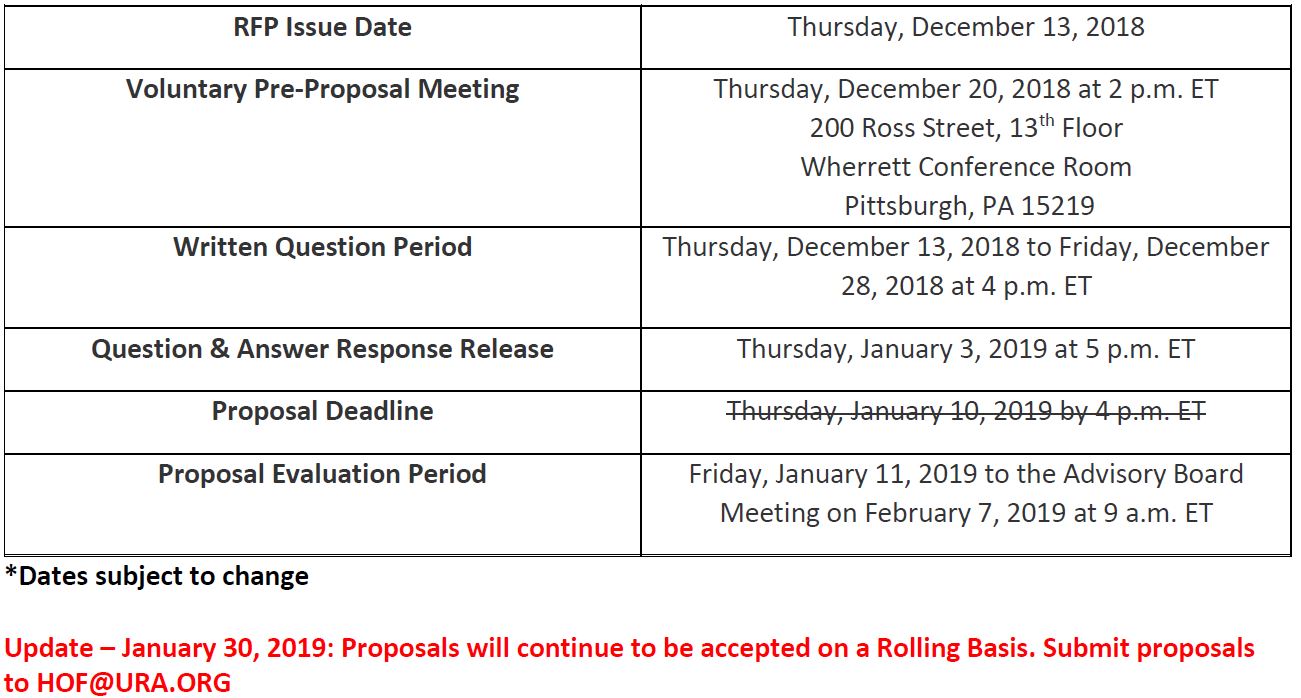

RFP Anticipated Timeframe*

Pre-Proposal Meeting

A non-mandatory Pre-Proposal Meeting will be held on Thursday, December 20 at 2 p.m. ET

200 Ross Street, 13th Floor, Wherrett Conference Room

Pittsburgh, PA 15219

This meeting serves as an opportunity to have questions answered about the RFP, submission process and the HOF HAP guidelines.

All questions and answers from the Pre-Proposal Meeting will be posted on Public Purchase.

RSVP your attendance to Evan Miller at emiller@ura.org.

Questions and Answers

All inquiries should be submitted through Public Purchase. All questions submitted by Friday, December 28, 2018, 4 p.m. ET will be responded to and made available on Public Purchase by Thursday, January 3, 2019, 5 p.m. ET. Inquiries received after that time will not be responded to.

Additional Information

Additional information regarding the URA may be found on the URA’s website at www.ura.org.

Submission Requirements

All application submissions are to include a completed HOF HAP Administrator Application Narrative (EXHIBIT D) and also include all attachments listed in the Attachments Checklist (EXHIBIT E).

The Application Narrative is comprised of the following sections:

I. Eligibility Checklist

II. HAP Administrator Qualifications

III. Pipeline Details

IV. Frequently Used Contractor Info Chart

V. Tangled-Title and Foreclosure Prevention Services Application

VI. Additional Information (optional)

All applicable sections of the Application Narrative must be completed to the best of the applicant’s ability to be considered a complete application.

All submissions must be electronically submitted to hof@ura.org

Selection Criteria and Review Process

Fully completed applications will be evaluated in accordance to the Scoring Criteria for the HOF HAP (EXHIBIT C), after which URA staff will present the application for funding to the HOF Advisory Board.

a. Applications will be evaluated using the criteria below:

I. Feasibility Criteria

1. Readiness to Proceed

2. Capacity of the Applicant

3. Program Delivery Cost Efficiency

b. Preference will be given to Program Administrators who:

i. Provide service citywide

ii. Demonstrate an established pipeline for the purposes of determining how quickly the projects can be done

1. Usage of Program Administrator pipeline will be at the discretion of the URA. All Borrowers will be required to participate in the URA intake process.

c. Application Review

After the January 10, 2019 proposal deadline, all proposals for Program Administrators will be evaluated by HOF staff, upon which a recommendation for 2018 HOF HAP Program Administrators will be presented to the HOF Advisory Board.

Note: As of 1/30/2019 applications will continue to be accepted on a rolling basis

Upon Advisory Board approval, selected Program Administrators will then be recommended to the URA Board of Directors for approval.

HOF HAP funds are not guaranteed to any proposer regardless of the Proposal Scoring Criteria score, and are subject to availability.

d. Guidelines

The URA Board of Directors may approve and disapprove awards to Program Administrators in accordance with the HOF HAP Program Guidelines (EXHIBIT B) and this RFP.

e. Deadlines

The Program Administrator must meet URA deadlines for submission of documents at each stage of the proposal process. Failure to meet the deadlines may result in the cancellation of the proposal and/or Program Administrator’s loss of a priority position for HAP funding.

f. Written Commitment Letter

Approval shall be evidenced by a written commitment to the Program Administrator.

g. Withdrawal of Application

Respondents may withdraw their HAP proposal at any time before final approval by giving written notice to the URA. The respondent shall bear any costs incurred for items related to their response.

Minority and Women-Owned Business Enterprise Participation (MWBE)

The URA has a long history of diversity and inclusion within all its programs and activities. The URA encourages the full participation of minority and women organizations and professionals in this effort. The URA will require that all Program Administrators demonstrate a good faith effort to obtain MWBE participation in work performed in connection with this program, including, but not limited to, administration and construction standards in the program guidelines (EXHIBIT B).

Any questions about MWBE standards should be directed to Diamonte Walker, director of Performance and Compliance, at mwbe@ura.org.

Legal Information

The URA reserves the right to verify the accuracy of all information submitted. The URA shall be the sole judge as to which respondent(s) meet the selection criteria. The URA reserves the right, in its sole discretion, to reject any or all responses received, to waive any submission requirements contained within this RFP, and to waive any irregularities in any submitted response.

By responding to this RFP, proposers acknowledge that the URA has no liability to any individual or entity related to this RFP or any proposal and/or the URA’s use or nonuse of any such proposal.

Non-Discrimination Certification

The Urban Redevelopment Authority of Pittsburgh abides by all applicable laws and regulations regarding nondiscrimination and refrains from discriminating on the basis of age, race, color, religious creed, ancestry, national origin, sex, sexual orientation, gender identity, gender expression, political or union affiliation, and/or disability. No person shall be excluded from participation in, be denied the benefits of, or otherwise be subjected to discrimination solely on the basis of any of the above factors under the loan and grant programs operated by the Urban Redevelopment Authority of Pittsburgh.