URA's Down Payment and Closing Cost Assistance Program Helping to Make Home Ownership a Reality

PITTSBURGH, PA (June 15, 2020) Mayor William Peduto announced that the Urban Redevelopment Authority of Pittsburgh (URA) recently closed on the 100th loan for its Down Payment and Closing Cost Assistance Program (DPCCAP). A Housing Opportunity Fund (HOF) program designed to stimulate housing investment, DPCCAP provides financial assistance to eligible first-time homebuyers in the City of Pittsburgh who are interested in purchasing an existing or newly constructed residential unit.

“We started this program almost exactly a year ago on May 1,” said Director of Housing Initiatives Jessica Smith Perry. “Now that the word is out about the program, the goal is to try to do twice the amount of loans over the next 12 months.”

The DPCCAP offers first-time homeowners:

- Under 80% of the Area Median Income (AMI) up to $7,500 in the form of a 0% interest, 5-year deferred loan.

- Between 80% AMI and 115% AMI up to $5,000 in the form of a 0% interest, 10-year deferred loan.

No payments are made during the term of the loan if residency requirements are met.

“Many people dream of owning their own home but due to numerous circumstances that’s all it will ever be — a dream. This program helps make that dream a reality,” Mayor Peduto said.

Noah Rectenwald

Noah Rectenwald is one of those new and proud homeowners who took advantage of the DPCCAP and the recipient of the 100th loan.

Noah Rectenwald had been renting in Lawrenceville for four years. He and his significant other found out about the HOF through Lawrenceville’s Community Land Trust homebuyer program, which they had applied to with hopes of owning a house in Lawrenceville. It soon became clear to them how daunting the upfront costs would be, so when they were told there was help through the DPCCAP they were excited.

“The HOF equalizes opportunity towards home ownership by supporting first-time buyers that qualify for assistance. The DPCCAP funds help eliminate the stumbling blocks of up-front costs that keep aspiring homeowners from achieving their goal,” said Rectenwald.

“Buying our home in Lawrenceville could not have happened without the HOF’s Down Payment and Closing Cost Assistance Program. We didn’t want to move and leave our neighborhood of four years. If not for this program, we would have had to continue renting and postpone our dream of homeownership.” Read more of Noah’s story.

Susan Smith

Easy. Accommodating. Friendly. Trustworthy. Those are just a few of the adjectives Susan Smith used to describe the DPCCAP.

“People were responsive and easy to communicate with, and they followed through. I can’t really separate the people from the program – the people make the program. The people running the program want it to be successful. The HOF support services are one of its greatest strengths. The breadth of services is wonderful.”

Susan and her husband had only lived in Pittsburgh for three years before they purchased their house.

“The HOF staff made something possible for us that we couldn’t have done on our own. They recognize that homeownership can be prohibitive for people. People that live paycheck to paycheck need security, too. Many of us are working over 40 hours a week, trying, and failing.

“For us, the assistance program was life-changing - we pay half of what we paid in rent in mortgage. And that’s with the escrow and the taxes, too,” said Smith. Read more of Susan’s story.

Celestin Uwintonze

Celestin Uwintonze had been living in Housing Authority housing when he heard about the program and was interested. He took the required first homeowner classes, and as a result of the background check discovered that he needed more time to improve his credit score.

“The URA representatives coached me on how to improve my credit score, and once I had paid my debts, I reached back to the URA, and that’s how it began,” said Uwintonze. “People might think they don’t have enough money to buy a house or improve their credit, but the HOF can support people in achieving these goals. They provide opportunities.”

Uwintonze has three children - a daughter and two sons - and really needed a 3-bedroom house for his family.

“A home loan is a large debt, and I really wanted to make sure I could afford the house long-term. I was very conscious of the long-term costs and knew I didn’t want to buy a house that would create too large of a financial burden for me and my family. I balance my budget every month, I do one project at a time, and am careful and thoughtful with my money. The HOF helped me buy a house we love that was within our means.”

They moved in December 2019. Read more of Celestin’s story.

In order to be eligible for DPCCAP, borrowers must meet the following requirements:

- The borrower’s annual gross household income may not exceed 115% of the AMI.

- The borrower must be purchasing the home as his/her primary residence and have his/her name on the deed.

- The borrower must not have any outstanding City, School, and County real estate taxes, or the borrower must be on a payment plan for at least six months.

Properties considered eligible:

- A permanent structure used primarily for year-round residential use. If the property to be improved is vacant, the borrower must certify in writing prior to closing his/ her intent to occupy the property within 30 days upon work completion.

- Each property may contain up to two connected dwelling units (i.e., duplex, townhouse), one of which must be owner-occupied.

A list of area providers that offer homebuyer education counseling and/or credit counseling can be found here.

Program information, including Area Median Income (AMI) amounts and guidelines, can be found here.

Application online here.

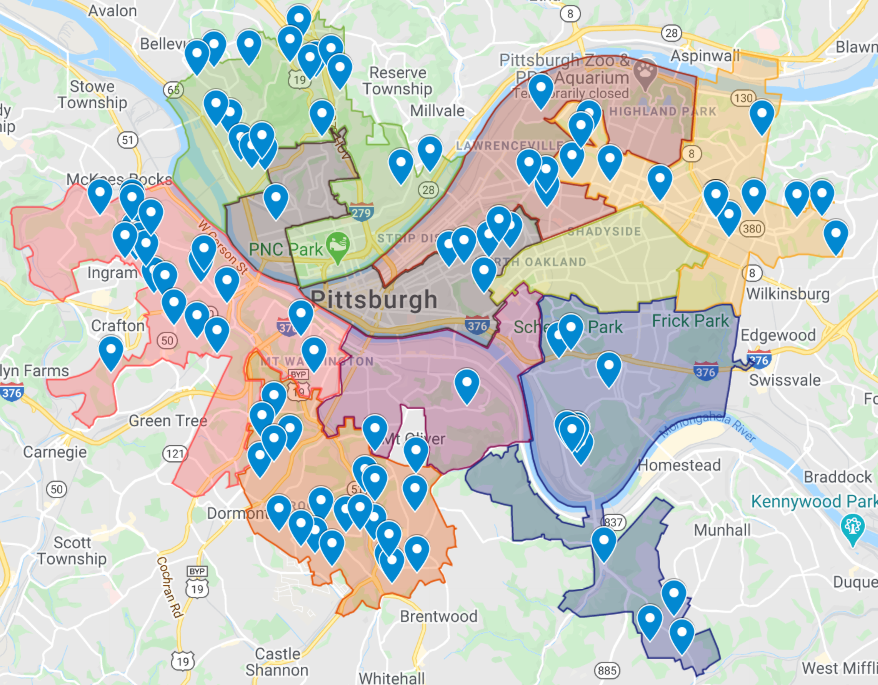

Below is a map showing where loans have been closed citywide: